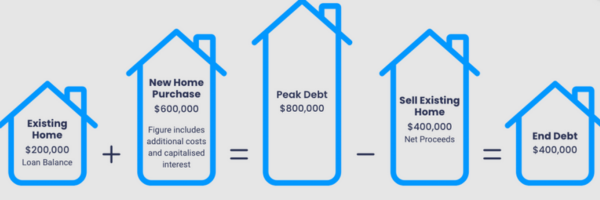

For many homeowners, the challenge of selling before buying—or vice versa—can feel stressful. This is where bridging loans can make all the difference. A Bridging loan is a short-term loan that helps you “bridge the gap” between buying something new and selling what you have.

It works by combining your existing mortgage with a new loan, typically for up to 12 months, with interest-only repayments during the loan term. The proceeds from the sale of your current property are then used to pay off the bridging loan, leaving you with only the loan for your new home.

How Bridging Finance works

- Buy Before You Sell

Secure your new home even if your current property hasn’t sold yet. - Leverage Existing Equity

Use the equity in your current home as security for the bridging loan. - Bridging loan Repayments

Bridging is a short-term finance facility where the capital and interest are paid off together at the end of the term. - Flexibility to Move Quickly

Make offers and move forward with confidence, without waiting for your sale to go through. - Up to 12 Months to Sell

You’ll usually have a set period (often up to 12 months) to sell your current property. - Repay the Bridging Loan

Once your existing home sells, the proceeds are used to pay down or clear the bridging component & interest accrued. - Standard Loan Continues

After the bridging portion is repaid, you continue with your standard home loan repayments for the new property.

Key Features

- Flexibility: It provides the flexibility to buy a new property without the pressure of selling your current one first.

- Avoids Rents and Storage: It helps you avoid needing to rent or move your belongings into storage while waiting for your property to sell.

- Time to Sell: It gives you time to prepare your current home for sale at your own pace.

- Pre-Approval: Bridging finance can often be pre-approved, allowing you to confidently house-hunt.

Things to Consider

- Sale Timeframe is Crucial – You will need to sell your current home within the lender’s maximum bridging loan term—typically up to 12 months.

- Higher Interest Rates- Bridging loans often have higher interest rates than standard home loans.

- Managing Two Loans – You’ll have to manage interest payments on both your existing and new mortgages (until your existing property sells)