Your credit score plays a big role in how lenders view your home loan application — and it can influence both the interest rate you receive and the loan options available to you.

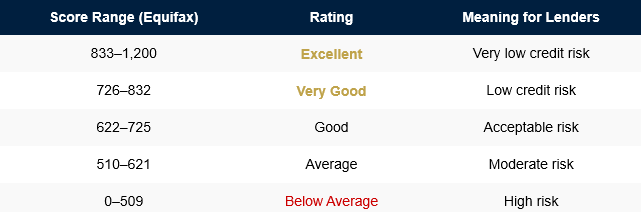

Your credit score is simply a snapshot of how you’ve managed money in the past. It’s calculated by credit reporting agencies and typically falls between 0 and 1,200 in Australia. The higher your score, the lower the risk you represent to a lender.