With property prices having increased substantially in Brisbane and across Australia over the past few years, many homeowners now have more equity in their homes than they realise. That equity can be the key to purchasing an investment property without needing to save a large cash deposit.

Here’s a simple example:

Let’s say your home is now valued at $900,000 and your current loan balance is $500,000. That means you have $400,000 in equity.

Most lenders will allow you to borrow up to 80% of the property’s value without incurring Lenders Mortgage Insurance (LMI). In this case:

- 80% of $900,000 = $720,000

- Less your current loan balance of $500,000

- Leaves $220,000 in usable equity

That $220,000 could be used as the deposit and costs for an investment property purchase. For example, it could allow you to buy a property worth up to $900,000, all by tapping into the equity you’ve built in your own home. The best part is you are not required to any cash down for the purchase as the equity covers the deposit + costs on this purchase.

The best part is that your home remains yours – you’re simply unlocking some of its value to help you grow your wealth and property portfolio sooner.

Every situation is unique, so the figures will look different for each client, but this gives you an idea of what might be possible.

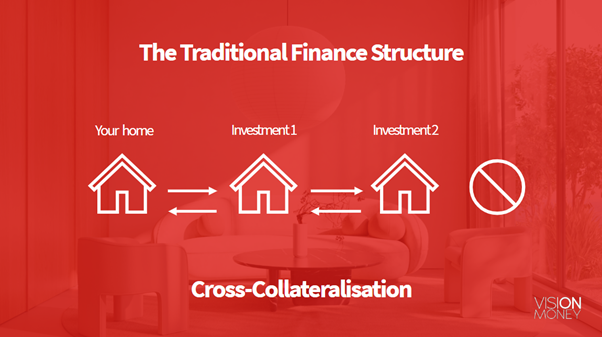

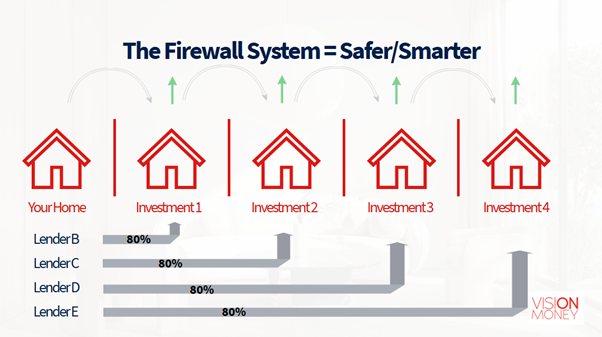

If you’re thinking of using your home’s equity to invest, it’s important to consider the set up. How you structure the loan matters just as much as the rate. One common trap is cross-collateralisation – and here’s why you should avoid it:

Don’t Cross-Collateralise

Linking your home and investment under one loan sounds simple, but it traps your equity, limits flexibility, and puts all your properties at risk.

Keep loans separate = more control, easier refinancing, and safer investing.